Benefits of 'normalized' monetary policy

The tone for 2011 was clear from the Central Economic Working Conference from Dec 10-12: The monetary policy will be changed from "loose" to "stable" and the policy should be "prudent" and "flexible".

In China, the monetary and credit policy is by far the most important macro policy since bank lending is about 130 percent of the nation's gross domestic product while government revenue is little more than 20 percent of GDP.

|

What does a stable monetary policy mean in China? We at UBS Securities think it means a continued normalization following an expansionary policy during the financial crisis. Essentially, we think bank lending (and monetary aggregate) growth will continue to slow in 2011, to about 15-16 percent in 2011 from more than 19 percent in 2010 and more than 31 percent in 2009. A stable policy also means that the government wants to avoid abrupt policy actions and the aim of the policies is to prevent an acceleration of investment growth and overheating rather than bringing growth down sharply.

A normalization of monetary policy is consistent with our expectations of multiple interest rate and reserve requirement hikes. China typically relies on three sets of tools to manage macro policy: Base money liquidity management (mostly through the sterilization of foreign exchange inflows using reserve requirement ratios and central bank bills), direct credit controls on commercial banks and sectoral investment rules (a form of industrial policy). Interest rates are used mostly as a tool to manage inflation expectations rather than disrupt lending, and the main consideration for exchange rate policy is trade and trade relations.

Since the onset of the global financial crisis, the People's Bank of China sharply reduced its sterilization of foreign exchange inflows to ensure an ample liquidity supply. As the trade surplus recovers, foreign exchange inflows have rebounded. But with further expected foreign exchange inflows in the world of the quantitative easing, the central bank needs to increase sterilization of its foreign exchange purchases, especially since inflation and inflation expectations are on the rise. Despite the existing high reserve requirement ratio (RRR) levels, we still look for multiple RRR hikes and increased central bank issuance in the coming year.

Normalizing credit policy would also require strict monthly/quarterly management of loan quota throughout 2011. Since late 2009, China effectively tightened its macro stance by lowering credit growth substantially. In recent months, credit growth picked up and is running at above 19 percent year-on-year. With the recovery in corporate earnings and rising inflationary pressure, we expect the government to set a lower credit target for 2011. A net increase of lending by about 7 trillion yuan (794 billion euros) will translate into an overall growth of outstanding loans at 15 percent next year, still higher than nominal GDP growth (13 percent). The slower loan growth will also mean that lending to local government investment platforms will continue to drop, as the banks, local governments and the central government gradually address and clean up outstanding loans.

We expect rates to be normalized very slowly over the next couple of years, with 100 bps rate hikes in the next 12 months to help anchor inflation expectations. Interest rates were lowered sharply at the onset of global financial crisis, and the real deposit rate has become increasingly negative - interest rate for one-year deposit is 2.5 percent, but CPI is running at 5 percent in November. We do expect CPI inflation to moderate gradually next year, but even the 100 bps rate hike can barely turn real deposit rates positive by the end 2011.

A faster yuan appreciation can help with China's structural change, control inflation and support monetary policy independence. Nevertheless, we think concerns about the impact on trade, capital inflows and asset prices will continue to dominate policy decisions. We expect the yuan to appreciate only 5 percent per year despite pressures from foreign exchange inflows and trading partners. Meanwhile, capital controls have been tightened at the margin to deter capital inflows. We think this trend will continue in 2011.

With regards to sectoral investment rules, we expect the government to keep a tightening bias on property demand to help stabilize property prices in large cities, but to increase the supply of mass market housing in conjunction with developing inland regions and improving social protection measures. We also expect the government to provide easier project approval and access to credit and land to new strategic industries, such as clean tech and equipments, advanced machinery and new energy.

The author is head of China economic research of UBS Securities.

Today's Top News

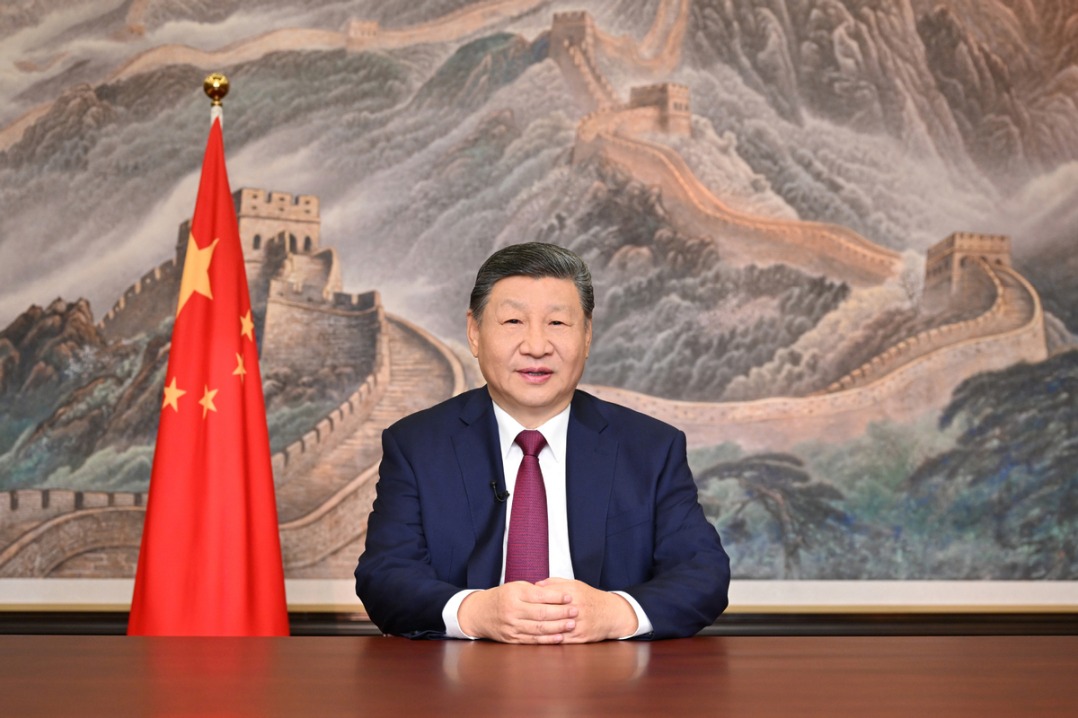

- Key quotes from President Xi's 2026 New Year Address

- Full text: Chinese President Xi Jinping's 2026 New Year message

- Poll findings indicate Taiwan people's 'strong dissatisfaction' with DPP authorities

- Xi emphasizes strong start for 15th Five-Year Plan period

- PLA drills a stern warning to 'Taiwan independence' separatist forces, external interference: spokesperson

- Xi, Putin exchange New Year greetings