How fast can housing investment grow?

Chinese leadership needs to introduce a property tax, which would be an integral part of any long-term solution

Urbanization and upgrading needs will create an estimated demand for 6 billion square meters of housing from 2017 to 2021. This will keep housing growing at around 5 percent in real terms over the next five years.

Investment demand, however, may lead to overbuilding and derail China's rebalancing and industrial upgrading agenda. The Chinese leadership therefore needs to promote reforms by introducing a property tax, which would be an integral part of any long-term solution, preferably implemented in a revenue-neutral manner.

Housing investment has grown rapidly over the past two decades, leading to a significant improvement in living conditions in China. Housing reform introduced in the 1990s allowed the development and sale of homes based on commercial principles. In the past two decades, investment in residential housing development has grown by an average of 19.2 percent per year. As a result, the urban living area per capita more than doubled to 36.6 sq m of gross floor area in 2016 from 17 sq m in 1996. With per capita living area increasing by about 0.8 sq m each year, China can close the gap with the average in the European Union in five years.

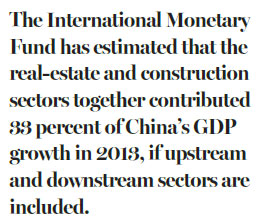

The housing sector has become too big to fail. Real estate investment accounted for more than 10 percent of the economy last year. The International Monetary Fund has estimated that the real-estate and construction sectors together contributed 33 percent of China's GDP growth in 2013, if upstream and downstream sectors are included. Bank lending to the real-estate sector totalled 26.7 trillion yuan ($4 trillion; 3.5 trillion euros; £3.08 trillion) last year, or one-fourth of banks' total credit outstanding. In addition, real estate is used extensively as collateral for corporate borrowing, and a major housing-market correction could undercut the value of the collateral.

Signs of property bubbles have prompted the government to introduce tightening measures since the fourth quarter of last year, which is likely to lead to slower housing investment in the near term. Following the stock market correction in 2015, housing prices soared by about 30 percent in first-tier cities last year. The government adopted city-specific measures late last year to contain property bubbles through restrictions on purchases, sales, prices and mortgages. Price increases have moderated in recent months, but at the cost of suffocating market activity.

Real demand, however, can sustain decent housing investment in the medium term. Urbanization continues to bring roughly 20 million people from rural to urban areas each year. Many migrant workers are living in very poor conditions. Most of the homes built before the 1990s lack modern amenities, and the demand for upgrading remains strong. We (Standard Chartered Bank) estimate that urbanization and upgrading needs will create at least 6 billion sq m of housing demand from 2017 to 2021.

We expect residential housing investment to grow by at least 5 percent per year over the five years. Demand is likely to be met by existing housing inventory and new commercial and social housing. At the end of last year, the total residential gross floor area waiting to be sold was roughly 400 million sq m. We forecast that 6.5 million units of social housing will be completed each year, based on the average of the past three years. Our calculations suggest that about 4.4 billion sq m of living area needs to be completed by developers in order to meet demand over the next five years, which requires new starts to grow by an average of 6 percent and gross floor area under construction to grow by about 5 percent each year, according to our residential housing investment model.

The challenge is to contain investment demand that may cause overbuilding. Given China's relatively closed capital account, housing remains the preferred investment vehicle for households. The risk-adjusted return from housing investment has been much higher than from other forms of investment, such as stocks and bank deposits. This has fueled households' desire to own multiple homes. This has artificially increased housing demand, pushing prices higher and stimulating investment.

Excessive housing investment, however, could derail China's rebalancing and industrial upgrading agenda. Building homes and keeping them empty represents a waste of natural and human resources, to say the least. More important, with resources flowing unduly to the construction sector, China's ambition to become a world leader in innovation and high-end manufacturing may be thwarted. In addition, rapid growth in property investment and housing prices has led to a concentration of wealth, exacerbating social inequality.

A multifaceted approach is needed to address the risk of property bubbles in China. The government has pledged to introduce long-term solutions to ensure the healthy development of the property market. We think long-term solutions should include a tighter bias for monetary and credit policy, more supply to meet real demand and, more important, a nationwide property tax to contain investment demand. The benefits of the property tax go beyond the property sector, since, as a recurrent tax, it increases the cost of holding multiple homes; as a dedicated local tax, it helps to put local government finances on a sustainable path; and as a direct tax levied on assets, it can mitigate the concentration of wealth.

Ensuring revenue neutrality could lower resistance to the introduction of a property tax. Local governments are generally reluctant to introduce a property tax for fear that it would discourage property investment and slow economic growth. For households, an additional tax burden on top of already high home prices is difficult to swallow, given that households acquire only 70-year land-use rights when they purchase a home. Thus, the tax needs to be carefully designed and accompanied by supporting measures in order to succeed.

We believe the following elements are important: A minimum living area per capita should be defined and exempted from the property tax, with the purpose of sparing a large portion of the population, presumably the less wealthy. Some of the existing property-related taxes can be merged into the property tax. Rates on other taxes - such as income tax, VAT and consumption tax - could be lowered to offset the impact of the property tax, leaving total tax revenue unchanged in principle. Adoption of a property tax needs to be accompanied by the granting of greater asset rights to households. In other words, the renewal of land-use rights after they expire in 70 years should be guaranteed.

The author is head of Greater China economic research at Standard Chartered Bank.

(China Daily European Weekly 11/24/2017 page13)

Today's Top News

- Mainland spokesman reiterates stand on Taiwan

- Xi to attend opening ceremony of National Games, declare Games open

- Xi urges deepening reform, opening-up during Guangdong inspection tour

- China releases white paper on low-carbon development

- What use are the humanities in the age of AI?

- Cameroon president congratulated on re-election