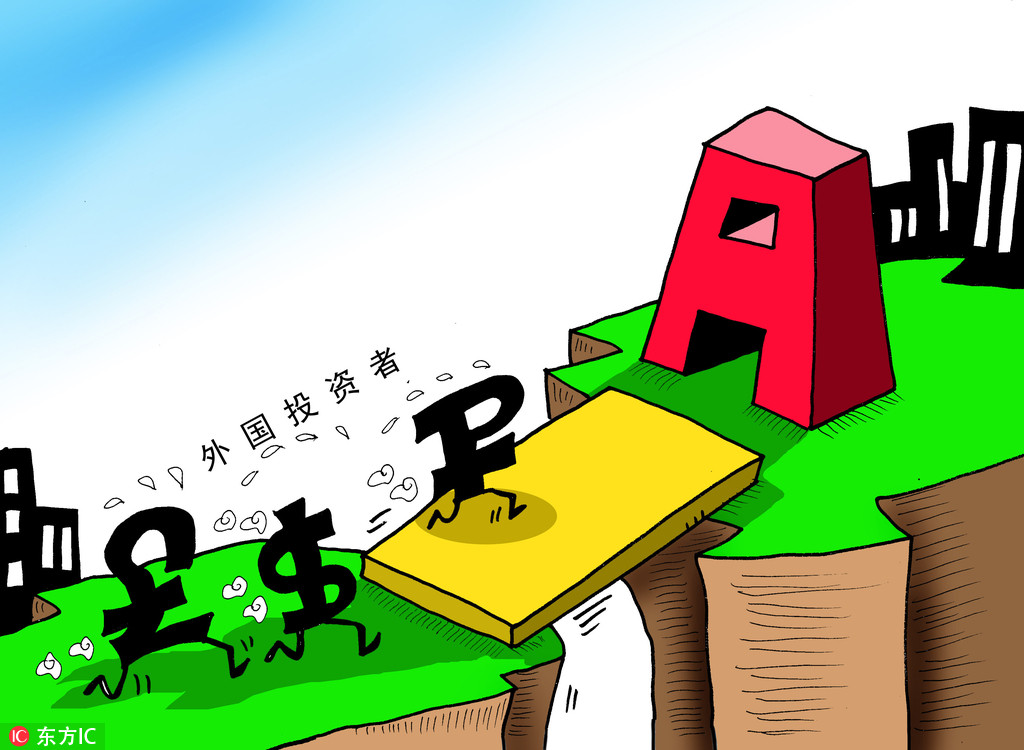

Foreign investors swear by A shares

Jan-July period sees $23.4 billion in inflows despite fears over trade rows

Overseas investors' committment to China's key A-share market remains unchanged despite the less-than-stellar performance of stocks in the past few months due to concerns over trade frictions.

At a news conference on Aug 10, Gao Li, spokesperson of the China Securities Regulatory Commission, said overseas investors pumped in 161.6 billion yuan ($23.4 billion) into A shares in the January-July period.

According to GF Securities, the corresponding figure for last year was 118.9 billion yuan, suggesting foreign investments rose almost 36 percent year-on-year.

Although the world trade frictions have intensified since June, capital inflows in June and July alone totaled 49.8 billion yuan.

As Gao explained, A-share companies' profitability has continued to increase since the beginning of this year, indicating their stocks may be good investment options.

The stock connect mechanisms between Shanghai, Shenzhen and Hong Kong have been one major channel for overseas capital inflows into the A-share market, market mavens said.

Data from Shanghai-based market information provider Wind Info shows that the benchmark Shanghai Composite Index slumped by over 14 percent in the January-July period while the Shenzhen Component Index dropped by nearly 18 percent.

The PE ratio of the A-share market is around 16 at present, hovering near its historic low.

Xu Xiaoqing, chief economist at DH Fund Management, said the A-share market's valuations are now low based on historical data. So, the coming two years could be an opportune time for investors to bag handsome bargains.

Agreed Xie Yunliang, an analyst at Guotai Junan Securities. US market valuations are comparatively higher at present, which is piling pressure on global investors. Given that the A-share market may be bottoming out and set for a rebound, investors may shift their attention to China, he said.

Inclusion of the A shares in Morgan Stanley Capital International's emerging markets index has also been a key driver of overseas investments.

The first phase of the inclusion on June 1 included only 2.5 percent of the total number of stocks in the A-share market in the emerging markets index. The second phase raised the figure to 5 percent on Tuesday. Meanwhile, the MSCI China Index included 236 A shares.

According to Shanghai Stock Exchange data, foreign capital has been flowing into stocks that are part of the MSCI indexes, via the Shanghai-Hong Kong Stock Connect. The inflows surged substantially to 11.27 billion yuan on May 31 alone, the last trading day before the MSCI index inclusion took effect.

That number hit a record high in terms of daily transaction volume throughout the first half of this year, which was also about 2.5 times the average amount of the monthly total of 4.4 billion yuan.

Analysts from China Merchants Securities wrote in a note the A-share market's 5 percent inclusion will hopefully bring in another 40 billion yuan of investments into the Chinese stock market by September.

Experts from Shenwan Hongyuan Securities predicted that the additional inflows may well reach 1.8 trillion yuan in the long run if all of the stocks in the A-share market are included in the MSCI indexes.

Easing of regulator restrictions on foreign investment has also helped inject more vibrancy into the market, market insiders said.

In June, the State Administration of Foreign Exchange and the central bank eased regulations on qualified foreign institutional investors or QFIIs and renminbi-qualified foreign institutional investors or RQFIIs. Under the new regulations, there is now no lockup period for QFIIs' and RQFIIs' capital. Besides, such investors are allowed to hedge foreign exchange.

"The opening-up policies for QFIIs and RQFIIs will help with the sustained development of China's capital market," said Hua Changchun, chief economist of Guotai Junan Securities. "The more diversified the investors, the healthier the market will be."