Issuance of special bonds could stabilize expansion, economists say

Local government special bonds may play a key role in stabilizing economic growth next year, according to analysts.

More such bonds are expected to be issued and a number of policy measures are underway to make this debt instrument more effective, they said.

Zhang Bin, director of the Global Macroeconomy Research Division at the Institute of World Economics and Politics at the Chinese Academy of Social Sciences, said, "A steady expansion of debt entailed by government activities, with optimizations in the debt structure, will be critical for achieving steady economic growth next year."

The Ministry of Finance recently assigned part of next year's quota of new local government special bonds, worth 1 trillion yuan ($426 billion), in advance. On Nov 27, the ministry said it had ordered local authorities to issue the bonds and make investments as soon as possible.

Zhang said this move signaled policymakers' intention to strengthen the role of special bonds in raising demand and countering downside pressure.

The bonds are issued by local governments to finance public projects and are repaid from income generated from these ventures.

"Given the weak impetus of corporates and households in expanding debt, the government is in a position to make up the shortfall and stabilize demand," Zhang said.

Yang Weiyong, an associate professor in economics with the University of International Business and Economics, said assigning part of the quota for next year in advance will help boost infrastructure investment from the beginning of next year. It would prevent "policy time lag"-the period between quota assignments and project investments-from impairing policy effect.

Other measures to boost the effectiveness of the special bonds are also underway.

On Nov 27, the State Council, China's Cabinet, released a notice stating that some infrastructure projects would be allowed to hold fewer equity funds and more liability funds. The proportion of equity required for port and water transportation projects was lowered from 25 percent to 20 percent of total project funds.

In September, the State Council decided to allow funds raised from the special bonds to be used as equity for major infrastructure works, such as transportation, energy and ecological projects and living services for vocational training, along with medical, elderly and child care.

It also said that the bonds should not be used in areas related to land reserves and real estate.

Yang said the measures will help leverage more capital from financial institutions to fund infrastructure projects and widen the impact of special bonds in spurring investment, as well as preventing the bonds from stimulating the property sector.

According to a CITIC Securities report, the total new special bond quota for next year may be set at between 3.3 and 3.35 trillion yuan, up from 2.15 trillion yuan this year.

The report said the higher quota, in tandem with measures to boost the efficiency of the bonds, may help infrastructure investment to grow at 5.5 to 6 percent year-on-year in 2020, compared with 4.2 percent during the first 10 months of this year.

Iris Pang, China director and economist at ING, a global financial institution based in the Netherlands, said the structure of infrastructure investment funded by the bonds is also expected to improve, with more funds flowing into medical care and education.

She said that so far this year, special bonds have financed many railway, airport and toll road construction projects. There is still room for investment in such areas, but this is narrowing as many regions already have the transportation networks they require.

Medical care and education projects may be a new focus, as they could generate a steady cash flow and cater to the growing need for public services, she said.

To improve the solvency of these projects, local authorities could "think out of the box of traditional patterns for public services and try tiered pricing strategies", Pang added. For instance, in addition to basic medical treatment, public hospitals could provide additional services with higher charges, such as private wards and nurses, she said.

Yang, from UIBE, said he saw plenty of potential for special bonds to provide more public services, such as setting up kindergartens and vocational training institutions.

He also said it is vitally important to prevent default risks by selecting projects that both improve public welfare and generate an adequate income for repayment in a sustainable way.

Yang believes that the risk associated with the increased issuance of specific bonds should not be a big concern, as the scale is still limited and the impact on the "leverage level of the entire economy is controllable".

- China's Global Governance Initiative receives positive feedback at forum

- China's Xizang sees steady tourism growth in 2025

- First-of-its-kind pearl auction held utilizing Hainan FTP

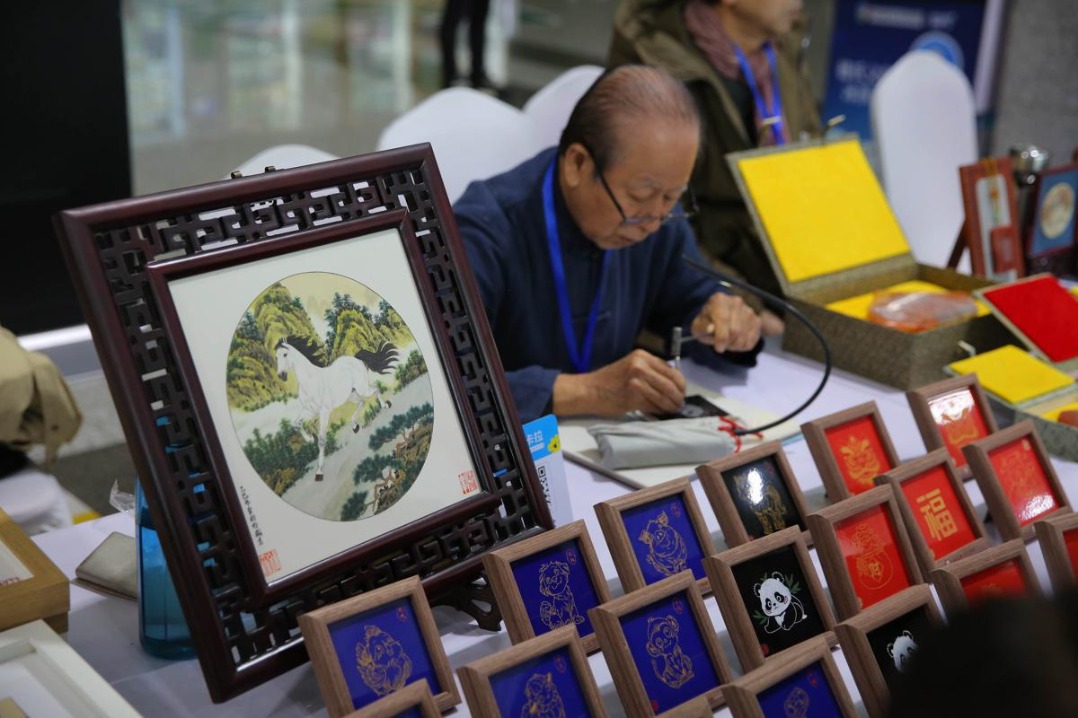

- Agarwood exhibition steeps Shanghai museum in fragrance

- The Fujian Coast Guard conducts regular law enforcement patrol in the waters near Jinmen

- IP protection for new fields to improve