More foreign-invested banks to get bond underwriting nod

Move expected to expand issuance channels for local governments, boost opening-up

More foreign-invested banks will be allowed to underwrite bonds issued by the local governments in China, as part of the country's financial sector's further opening-up efforts, experts said.

Allowing foreign-invested banks to participate in the underwriting will not only bring in more overseas investors, but also boost the faster expansion of the country's 20 trillion yuan ($2.9 trillion) local government bond market this year.

Local governments are expected to issue 135 bonds worth more than 400 billion yuan this week, the highest issuance in history, according to data released by the China Central Depository and Clearing Co Ltd.

To ensure that enough funds can be raised and used for infrastructure projects, the Ministry of Finance has urged local governments to revise the rules so that fully foreign-funded banks, Sino-foreign joint venture banks and foreign banks' branches in China can all underwrite local government bonds.

Three foreign-invested banks-Fubon Bank, the Bank of East Asia and Deutsche Bank, are already part of the local government bond underwriting groups, said the Ministry of Finance. It means that these banks will now be able to sell the bonds to their clients, including overseas investors.

The new policy, in line with the country's financial sector opening-up strategy, will expand the issuance channels of local government bonds, and promote the diversification of bond investors, said the ministry in a statement. In addition, "it will make the bond issuance sustainable, facilitate the opening of the government bond market, and promote the internationalization of the renminbi."

Yulia Wan, a vice-president and banking analyst at global credit ratings agency Moody's Investors Service, said: "We expect more foreign banks to join local government bond underwriting groups, which can help complement current sales channels and diversify investor base for local government bond issuances."

Joining the local government bond underwriting groups can help foreign banks diversify their business in the Chinese market and increase their source of income, Wan told China Daily on Tuesday.

China's foreign exchange regulator, the State Administration of Foreign Exchange, also launched new strategies to attract foreign investors to the domestic bond market on Monday. It said that foreign institutions, both banking and non-banking investors, can trade in the interbank foreign exchange market, using financial instruments and derivatives to hedge foreign exchange risks.

The SAFE will continue to push forward the opening-up and reform of the foreign exchange market, and better serve the real economy, according to a statement on the website.

China's bond market may attract more capital inflows than 2019 this year as some major central banks and private sector firms will increase their investment in Chinese bonds, said a research note from China Merchants Securities. Foreign institutions purchased Chinese bonds worth 457.8 billion yuan last year, up 32 percent from 2017, the note said.

Local governments' new bond issuance stood at 3 trillion yuan during the January-to-November period of 2019, and outstanding local government debt reached 21.3 trillion yuan at the end of November, below the debt ceiling of 24.1 trillion yuan, according to data from the Ministry of Finance.

To improve the transparency and disclosure of local government financial information, the Ministry of Finance established a website earlier this month that discloses detailed debt and financial data by province-level regions.

Several provinces have revealed issuance plans for special purpose bonds with total planned issuance in January 2020 of around 564.6 billion yuan, said a report from Moody's.

"The early allocation of the 2020 bond quota allows local governments to issue bonds one month earlier than the previous process. Because early allocations of special bonds are not allowed to be used for property-related projects like land reserves and shantytown renovation, we expect infrastructure investment growth to pick up at the beginning of this year," it said.

Today's Top News

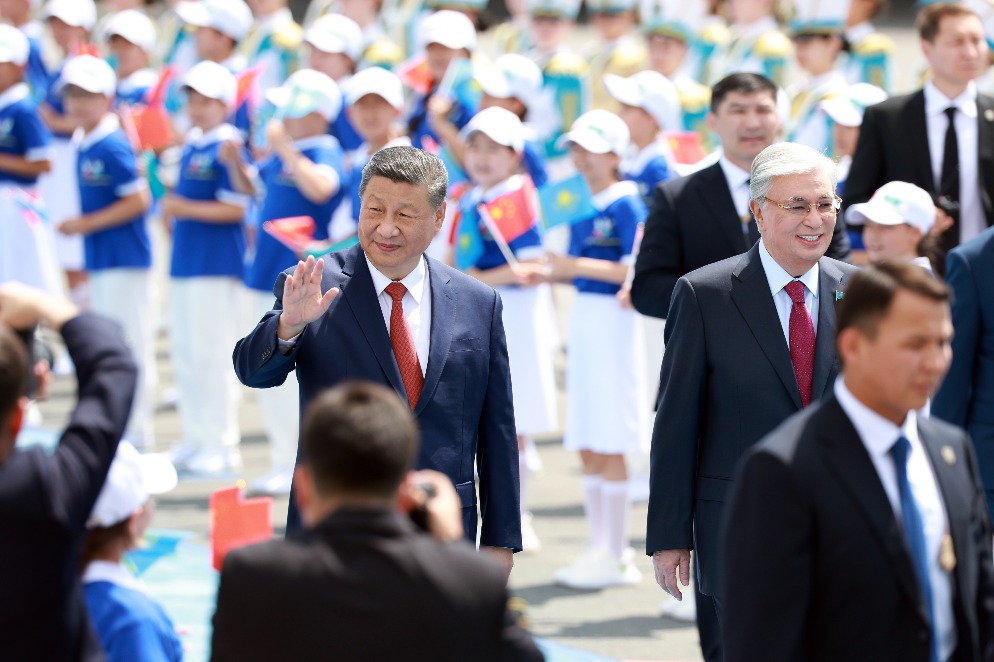

- Cooperation between China, region becomes increasingly important

- Along ancient Silk Road, Xi cultivates stronger bonds with Central Asia

- Sino-Kazakh cooperation strengthened

- Sino-Uzbek agro-cooperation fruitful

- Retail sales surge points to strong resilience

- Intensified Mideast conflict spurs calls for de-escalation