China likely to increase tolerance for bad debts of small businesses

China will further increase its tolerance for loans to small businesses that turned bad to help them traverse hard times due to the novel coronavirus outbreak, especially in regions where the epidemic impact is huge.

"For banks in the regions that are seriously affected by the novel coronavirus outbreak, the China Banking and Insurance Regulatory Commission will fully consider the impact of the epidemic with a down-to-earth attitude, appropriately increase its tolerance for nonperforming loans in these regions, and allow a grace period for these banks to meet regulatory requirements or make flexible arrangements of regulatory measures accordingly," said Liang Tao, vice-chairman of the commission, at a recent news conference held by the State Council Information Office.

The commission's Shanghai office recently encouraged the local banking sector to cut or waive loan interest rates over a certain period of time for companies that are severely affected by the epidemic. It also allowed banks to set a grace period during which these firms will not be charged compound interest or penalties on loans that are overdue.

Regulators in Jiangsu and Zhejiang provinces also said they will tolerate higher bad loans to support stricken firms. They encouraged commercial lenders to offer loan extensions to firms that have temporary financial difficulties, in addition to allowing these companies to make deferred loan payments, repay loans through installments, or renew loans without repayment of principal.

The regulator took temporary policy measures such as encouraging banks to allow certain companies delay payments of loan principal and interest that will mature before June 30, said Xiao Yuanqi, chief risk officer and spokesperson of the commission.

"We are adopting this measure for the time being to help companies going through temporary difficulties caused by the epidemic, rather than relaxing regulatory standards," Xiao said on Tuesday. "This measure will also help banks better prevent risks. If we don't help the companies that ran smoothly before the epidemic, their loans may turn sour."

Whenever business operations return to normal after the epidemic, and some companies still cannot make loan repayment, banks should record the loans past due for 90 days as nonperforming loans according to regulations, he added.

Fan Yifei, deputy governor of the People's Bank of China, said the NPL ratio of the Chinese banking sector is relatively low compared with many other countries, leaving a fairly large room for regulators to make temporary adjustments. Official data show that the NPL ratio of commercial banks stood still at 1.86 percent at the end of the fourth quarter last year.

Wen Bin, chief researcher with China Minsheng Banking Corp, said: "Micro-and small-sized enterprises have a weak anti-risk capability, so their nonperforming loan ratios are usually higher than large companies. Only by increasing regulators' tolerance for bad loans at small businesses will banks get motivated to issue small business loans."

Wen said a set of detailed and feasible standards should be adopted as a supplementary measure, under the leadership of China's top banking and insurance regulator, so that loan officers will not be held responsible for defaults on loans to small businesses once they have performed appropriate due diligence. Currently, the standards are not unified among different departments of the regulator, causing implementation challenges.

"The overall risk associated with nonperforming loans of the Chinese banking sector remains controllable. However, during the process of giving financial support to economic recovery and the battle against the epidemic, banks should also prevent excessive credit expansion, prevent certain companies from escaping debt repayments, and prevent businesses from using loans for purposes other than operations," he said.

Banks will continue to increase lending to small businesses, especially those driving employment or directly engaged in the fight against the novel coronavirus outbreak, said Xiong Qiyue, a researcher with the Bank of China Research Institute.

"We estimate that commercial banks' nonperforming loan ratio for small businesses will rise in the first half due to the epidemic. Over the same period, the banking sector's profitability indicators such as net interest margin will drop on a yearly basis," Xiong said.

Today's Top News

- China-Cambodia-Thailand foreign ministers' meeting held, press communique issued

- Drills demonstrate China's resolve to defend sovereignty against external interference

- Trump says 'a lot closer' to Ukraine peace deal following talks with Zelensky

- China pilots L3 vehicles on roads

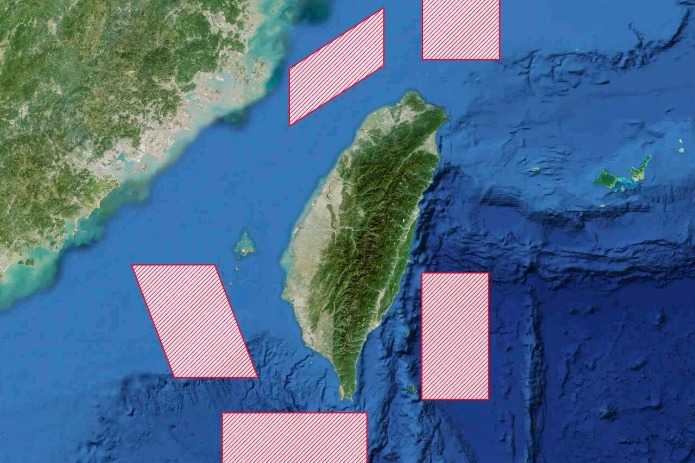

- PLA conducts 'Justice Mission 2025' drills around Taiwan

- Partnership becomes pressure for Europe