Financial sector key to carbon neutrality goal

International experiences in the financial sector's support for carbon neutrality mainly fall into two categories.

The first is about how to drive private-sector capital toward investments in low-carbon ventures.

The second is about guarding against climate risks.

Both factors are important. They require both catalyzing more green funding, and at the same time causing funds to retreat from high-carbon industries in an orderly manner.

The following international experiences are relevant to China.

International standards shall be fully learned and borrowed. We shall look at international practices in the standard of identification of green and sustainable finance.

Recently, the European Union has approved the taxonomy for sustainable finance. In this taxonomy, the EU raised the important "no significant harm principle".

It has also made clear that any project that is categorized as being supported by sustainable finance must not have any damaging effect on any sustainable goals, including the environment, climate and biodiversity.

The first edition of China Green Bond Endorsed Project Catalogue was released in the year 2015 and has borrowed some principles from the "no significant harm principle "from the EU.

It ruled out high-carbon projects, but also included some green projects that might in fact damage our climate goals, such as clean coal projects.

The situation back then was understandable as in 2014 and 2015, tackling air pollution remained front and center for environmental policymakers.

Therefore, some projects, particularly clean coal technology, were included as support target for green finance because they can bring down the levels of sulfur dioxide, oxynitride and dust, though they cannot bring down the levels of carbon dioxide.

However, the situation we face now is different. The average PM2.5 level in Beijing has reduced from 90 in 2013 to 38 in 2020, which is very close to the 2030 goal of 35. At the same time, China's central authorities have raised the goal of reaching carbon neutrality by 2060. This will become the most important measure for future green development and building a circular economy.

Therefore, there will be a great shift in policymaking on the environment front. This will also make implementing the "no significant harm principle" more eligible.

In other words, our green standards must make sure that key goals of tackling climate change shall not be harmed. If any damage is caused, such project shall not be supported by green finance even with other possible positive effects.

Although we have been learning a bit from the "no significant harm principle", such learning won't be sufficient. The Green Bond Endorsed Project Catalogue has been revised, but there are still high-carbon projects in other green finance catalogs. More revisions shall be made to these catalogs in accordance with the "no significant harm principle."

What's also important is the risk analysis of environmental climate, which is about using methods such as stress testing to assess how environment-and climate-related factors may effect financial institutions' asset quality and financial risks.

So far, there are only three banks in China that have trailed such tests, while most Western large-scale financial institutions have started such tests, making China relatively lag behind in this regard. According to a research report that my team and I authored in 2020, in the process of reaching carbon neutrality, probability of loan default of sample coal power companies in China may rise from the 3 percent level to 22 percent in 2030.

- Population figures underline labor productivity and value-added

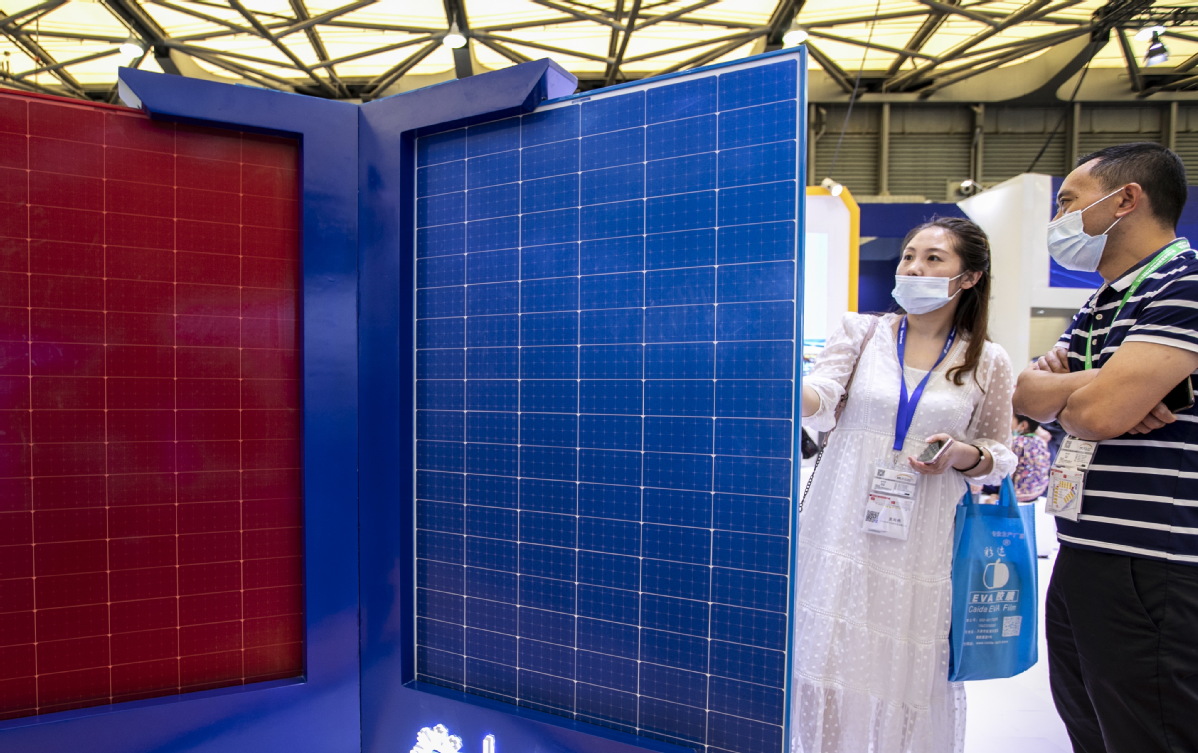

- With China's aid, solar park in Argentina helps strengthen poverty fight

- Market-based boost for green technologies key to low-carbon transition

- Cosmetics and personal care products that can beautify world

- On long-term investing, dancing with risk against backdrop of reflation