Hong Kong stock investors told to take cover

Equity experts are warning about the regulatory risks of putting money into individual Hong Kong stocks, saying investors should focus on equity indexes and old-economy shares. Oswald Chan reports from Hong Kong.

China's intensifying crackdown on technology behemoths, on the heels of the probes into ride-hailing giant Didi Chuxing Technology Co and education companies, coincides with the mounting scrutiny of Chinese enterprises seeking to raise funds in the United States.

The moves by the mainland and US regulators have sent shock waves across Hong Kong's equity market. The benchmark Hang Seng Index tumbled from its highs in the first quarter of this year before consolidating in the second quarter.

Amid lingering regulatory risks on the mainland and global uncertainties arising from COVID-19, the HSI took a beating for two consecutive days — plunging a total of more than 8 percent on July 26 and July 27. The Hang Seng TECH Index, which represents the 30 largest technology companies listed in Hong Kong, has lost nearly all its gains since its inception more than a year ago. Southbound fund flows under the Stock Connect programs between Hong Kong and the mainland saw the largest net outflows on record of HK$63.5 billion (US$8.16 billion) last month, according to OCBC Wing Hang Bank.

On Aug 12, the benchmark index closed at 26,517, 2.62 percent lower than it was at the end of December, even though the index had rebounded from the previous low level at the end of July.

Hang Seng Investment Management — a wholly owned subsidiary of Hang Seng Bank — warned investors of a string of risks in the Hong Kong stock market: Would the worsening pandemic affect customs clearance procedures between the special administrative region and the mainland? Would the mainland's tough supervision of technology companies hurt the valuation of Hong Kong stocks? Would Hong Kong's economic recovery be slower than expected? And would the People's Bank of China substantially tighten its monetary policies?

Mandatory Provident Fund advisory services provider Gain Miles expects mainland authorities to continue clamping down on the real estate and education industries, with the technology and livelihood sectors seeing a higher degree of supervision and intervention.

Swiss-based asset manager UBS rates Hong Kong's equity market as the "least preferred", saying the market's fundamentals are relatively weak, and the city is more sensitive to the overall trend of US interest rates and the greenback.

However, experts' predictions for the local stock market's performance by year-end are mixed, with the HSI projected to stay between 27,000 and 30,000 points, and the Hang Seng TECH Index ranging from 6,500 to 8,000.

Equity analysts suggest that investors should adopt a thematic or exchange-trade fund approach, rather than putting their money into individual stocks, as a risk diversification strategy. Traditional old-economy shares also will offer good investment potential when their market valuations become attractive again after the recent market jitters.

Bloomberg sees the forward price-earnings ratio of the HSI and the Hang Seng Chinese Enterprise Index standing at 11.8 times and 9.6 times respectively, indicating that Hong Kong stock indexes are inexpensive compared with their global peers, as policy uncertainties have driven large share valuation discounts.

French-based asset manager BNP Paribas said that thematic stock baskets, such as green energy, economic reopening and reflation (capital goods, autos, technology and materials), and internal circulation (technology, consumer, healthcare and industrial) can continue to outperform in the near term as broad-based equity indexes are likely to remain range-bound until regulatory policies can be further clarified.

"Mainland technology stocks of platform economy players with market monopoly positions, as well as technology shares relating to national security or livelihood, will be targeted in the current regulatory probes. On the other hand, shares relating to domestic demand, consumption and semiconductor-related stocks may benefit from the country's regulatory policies," Venture Smart Capital Managing Partner Kenny Tang told China Daily.

- ECNU's intl student program benefits mother and daughter from Vietnam

- Digital creativity shines at intl copyright expo in Qingdao

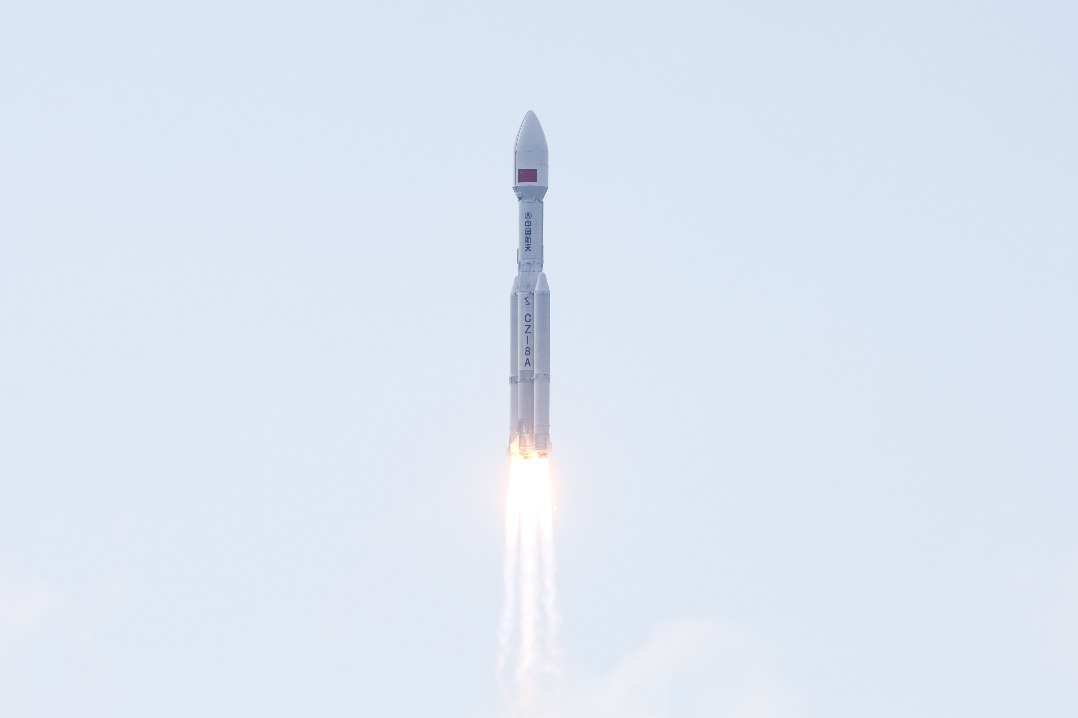

- China's rocket launches Pakistan remote-sensing satellite into orbit

- Legal scholars affirm Taiwan resolution at UN seminar in Wuhan

- Shanghai demonstrates ecological protection, building a green future

- Lithium battery spontaneously combusts on flight from Hangzhou in China to Seoul, no injuries reported