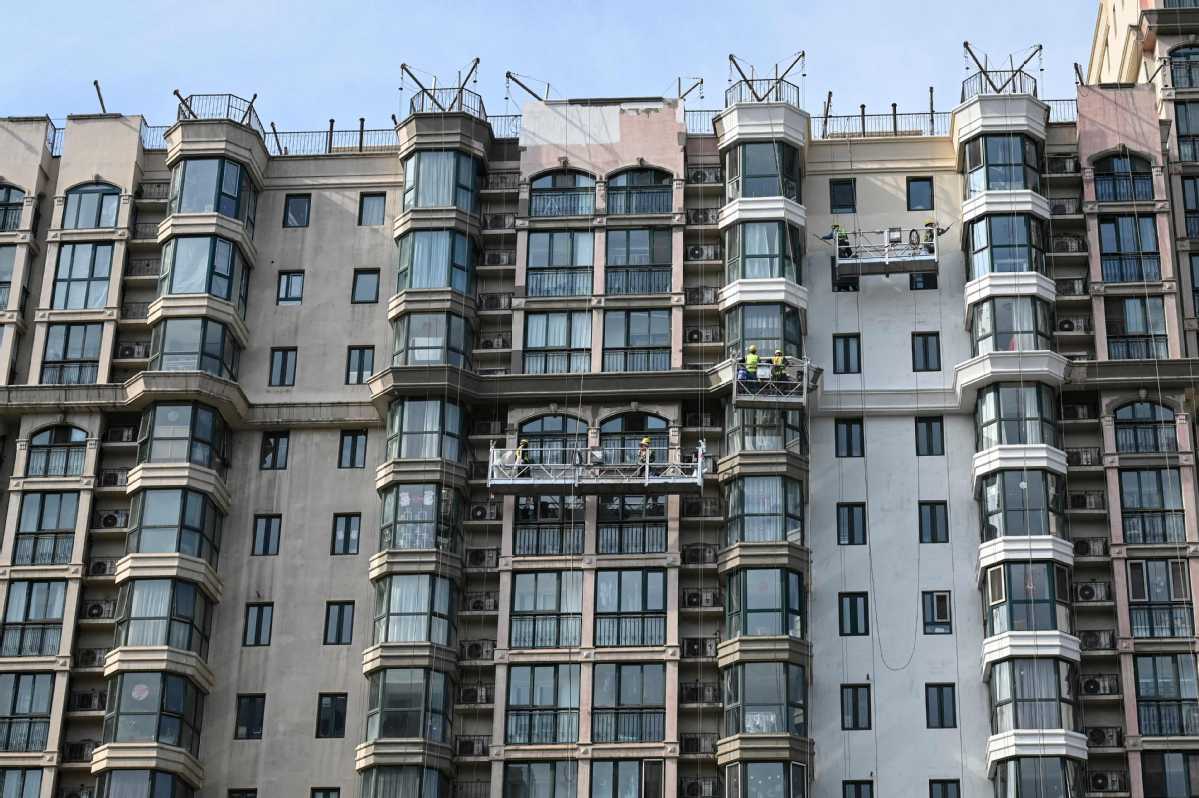

Mortgage rates drop to shore up housing sector amid COVID woes

Cities put forward combo measures with lower LPR to stabilize economy

Housing mortgage interest rates in some first-tier cities-Beijing, Shanghai and Guangzhou, Guangdong province-h(huán)ave been trimmed following the latest benchmark lending rate cut, while industry experts suggested there is still space for lower home loan interest rates in some Chinese cities.

Personal home lending interest rates in the top-tier cities of Beijing, Shanghai, and Guangzhou have widely applied the latest over-five-year loan prime rate (LPR) by commercial banks, following the central bank's adjustment of the market-based benchmark lending rate from Friday, the China Securities Journal reported.

The People's Bank of China, the central bank, announced the over-five-year LPR, on which many lenders base their mortgage rates, was lowered by 15 basis points to 4.45 percent, while the one-year LPR stood unchanged at 3.7 percent.

"The cut raised market expectations for an overall recovery of the home market as soon as the COVID-19 outbreak comes under control," said Zhang Dawei, chief analyst at Centaline Property Agency Ltd.

Zhang said this is the first time, since the scheme was launched, that the central bank lowered the over-five-year LPR, and this is also one of the largest cuts in scale, indicating that a stable economy can only be achieved after stabilization of the property market.

"Together with the financial authorities' previous measures, the lowest home mortgage rate is as low as 4.25 percent, showing the central government's resolution to stabilize the economy and the property market," wrote a Zhuge Real Estate Data Research Center report.

According to a joint statement made by the PBOC and the China Banking and Insurance Regulatory Commission (CBIRC) on May 15, based on the corresponding tenor of a benchmark LPR, first-time homebuyers can receive 20 basis points below the lower limit of interest rates on home loans from commercial banks.

In fact, following the latest adjustment in over-five-year LPR, housing loan rates for first-time homebuyers in several commercial banks in Tianjin, Jiangsu province's Suzhou and Wuxi, have come down to 4.25 percent, Shanghai-based cls.cn media reported.

Chen Wenjing, deputy director of research with the China Index Academy, said he believes a large number of Chinese cities may lower their home mortgage interest rates to the minimum level.

"The lower home loan interest rate will lower home buyers' costs in home purchasing, boost market confidence and activate market expectations for the property market," Chen said.

Currently, the real estate market recovery has been interrupted by the current outbreaks of COVID-19 in some Chinese cities, which means it may take some time for existing measures to take effect, Chen added.

Chen said demand in the second quarter may continue to stay at low levels due to the continuation of the contagion and "a gradual market recovery can come into place in the second half of the year".

Li Yujia, chief researcher at the Guangdong provincial residential policy research center, said first-tier cities, in contrast, have limited room for home loan interest rates to go further downward, due to their strong fundamentals.

Demand in the nation's biggest cities, though temporarily confined by the outbreak, will resume as soon as the pandemic is under control, Li added.

As of Friday, at least 56 cities have announced respective policies to stabilize their home markets in May, the Securities Times reported, citing statistics from Centaline Property.

These measures are distinctive with new characteristics, said experts.

Those adopted in the cities of Wuhan, Hubei province, Hangzhou, Zhejiang province, and Dongguan, Guangdong province are not simply encouraging rational demand, but combining their local real estate policies with their demographic and talent measures, trying to establish a package of family support solutions that cover marriage, childbirth, education, housing, pension and social security, among others, Zhang Lei, a researcher from Peking University, was quoted as saying by the Securities Times.

In tandem, the flexible and tailored measures taken in accordance with the special conditions of a specific city are believed to better suit the respective city's home market.

Li said top-tier cities do not need additional policies except for the nationwide home loan interest rate cuts, because demand can quickly be restored once the COVID-19 outbreak is contained.