Chinese suppliers pursuing advanced auto intelligence

Domestic smart vehicle tech companies showcasing stronger competence through R&D collaborations with international car brands

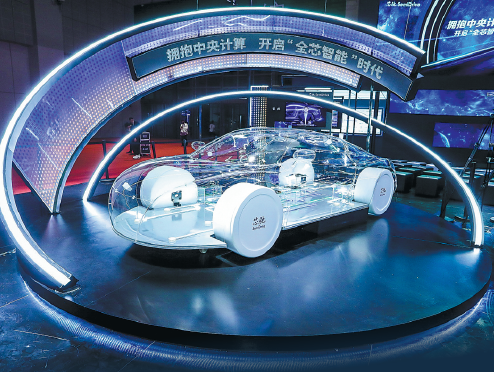

As the global auto industry accelerates its transformation toward intelligent mobility, Chinese parts suppliers are taking the lead in steering innovation and product development.

From supplying key components to co-developing next-generation driving systems, domestic intelligent vehicle tech companies are demonstrating stronger competence through research and development collaborations with international car brands.

Last week, BMW Group announced a partnership with Chinese smart driving startup company Momenta to jointly develop an advanced driver-assistance system (ADAS) tailored specifically for the Chinese market. According to the two sides, the cooperation is expected to combine the strengths of both companies in artificial intelligence and automotive engineering, while focusing on local driving habits and road conditions to deliver a truly "homegrown" intelligent driving experience for Chinese users.

Earlier this year, German automotive technology giant Bosch announced a partnership with Beijing-based Horizon Robotics to co-develop next-generation multifunction cameras based on the latter's Journey 6B chips, and upgraded driver-assistance systems powered by Journey 6E/M chips.

"China has become a global innovation hub for automotive intelligence," said Christoph Hartung, president of Bosch's intelligent driving and control systems unit, adding that the company looks forward to deepening cooperation with outstanding Chinese partners like Horizon Robotics to advance the global development of driver-assistance technologies.

A month earlier, Wuhan, Hubei province-based Ecarx signed a partnership with Volkswagen Group to supply intelligent cockpit solutions for Volkswagen and Skoda models, with the first wave of products set to launch in Brazil and India.

The high-profile deals serve as a reflection of a new cooperation trend. "China is evolving from being merely a consumer market to becoming a global hub for technological innovation and supply chain leadership," said Zhang Yongwei, vice-chairman and secretary-general of China EV100, a non-governmental research and policy institute.

In this regard, Zhang believes that multinational automakers need to revisit their strategies in China by boosting local R&D and strengthening partnerships with domestic suppliers in order to leverage the country's innovation edge on a global scale.

This shift is increasingly felt at the component level. According to Zhang Haizhou, chief brand officer of domestic positioning sensor company Asensing, it's becoming increasingly common for Chinese parts suppliers to co-develop new products with foreign automakers.

"Domestic suppliers are gaining greater technical capabilities and a stronger voice," Zhang Haizhou said. "We're no longer just downstream providers — we're now co-creators, helping define and realize intelligent automotive platforms on a global scale."

He noted that Asensing has gone beyond simply supplying sensor units by collaborating with multiple domestic and international automakers in the development of next-generation driver-assistance systems, providing full-spectrum expertise covering both hardware and software.

The company has to date partnered with more than 30 global carmakers and delivered over 3 million positioning sensor systems across a wide range of vehicle types and price segments, he added.

The move toward co-development is also reshaping expectations in the chip sector. For auto-grade chipmakers like Beijing-based SemiDrive, the trend calls for both forward-looking vision and precision in product definition through deepened cooperation.

"Co-development requires not only a deep understanding of vehicle architecture, but also close collaboration and in-depth communication with carmakers and ecosystem partners across the supply chain to jointly explore emerging needs and industry pain points," said Chen Shujie, vice-president of SemiDrive.

Every new generation of the company's products is jointly defined with automakers before it's officially launched, Chen said, adding that as soon as the specs are finalized and the first samples are out, projects are already underway, which proves "how spot-on the product definitions are".

As Chinese auto-grade chips reach new levels of technical maturity, international automakers are strengthening their presence in the country, Chen added.

"We're seeing a clear trend that international automakers are relocating their research and development centers to China and stepping up engagement with local supply chains," she noted.

According to Chen, SemiDrive has already established joint laboratories with multiple automakers, such as SAIC Volkswagen, to co-develop software and hardware platforms for intelligent vehicles. It has also entered mass production partnerships with other joint ventures such as Dongfeng Nissan, Dongfeng Honda and FAW-Volkswagen.

"Automotive semiconductors rely on highly globalized collaboration. Deepening international cooperation is essential to boosting China's competitiveness in this sector," Chen said.

Wu Songquan, senior chief expert at China Automotive Technology and Research Center, sees this joint development between automakers and component suppliers as a necessity in today's competitive ecosystem-driven landscape.

"Automakers are evolving from supply chain dominators to ecosystem coordinators and co-builders," Wu said, explaining that the situation is led by the shift toward electrification, connectivity and intelligence, where the traditional pyramid-style supply chain is giving way to a more networked structure.

Under the new pattern, automakers must work directly with suppliers at every tier and engage in early-stage design, to achieve both cost control and innovation, Wu said.

"The growing demand for cutting-edge technologies is prompting automakers to establish a 'symbiotic relationship' with parts suppliers in key technical areas, placing greater emphasis on deep collaborative R&D and shared risk," he added.

As China's smart vehicle supply chain becomes increasingly stable and comprehensive, foreign carmakers are realizing that collaboration with Chinese partners is key to advancing their intelligent progress, Zhang of Asensing added.

"For global brands, shipment volume is a major factor when selecting partners, as it is a direct reflection of product reliability and stability," Zhang said.

China's large-scale deployment of assisted and intelligent driving has provided new auto parts with more opportunities for installation, testing, mass production and application, thus making the products more mature, he said.

The executive further noted that the country's widespread adoption of smart driving technologies is creating a virtuous cycle.

"Mass usage drives technical refinement, which in turn elevates supplier capabilities."

"Only in China can automakers find a smart driving supply chain that is truly mature, reliable, high-performing and validated at scale," the executive emphasized.

The observations are reinforced by industry data. According to data from the China Passenger Car Association, from January to April, the installation rate of Level 2 and above ADAS in new energy passenger vehicles stood at 77.8 percent.

Zhang Haizhou's views align closely with those of SemiDrive's Chen, who also sees the country's maturing industry ecosystem as a major driver behind the deepening ties between domestic suppliers and global automakers.

"Being widely tested and adopted by local automakers, domestic auto-grade chips are now mass-produced mature products with proven stability and reliability," Chen said.

The market's large shipment volumes, coupled with its rapidly evolving industry environment, have made its solutions not only proven in practice but often more advanced than the options available in customers' existing supply chains, she added.

To date, SemiDrive's full lineup of automotive-grade chips has surpassed 8 million units in cumulative shipments, covering more than 100 vehicle models from over 260 customers.

Ma Si contributed to this story.

Today's Top News

- China urges the US to cease provocative actions

- Hope, skepticism and questions ahead of Trump-Putin summit

- Xi's article on promoting healthy, high-quality development of private sector to be published

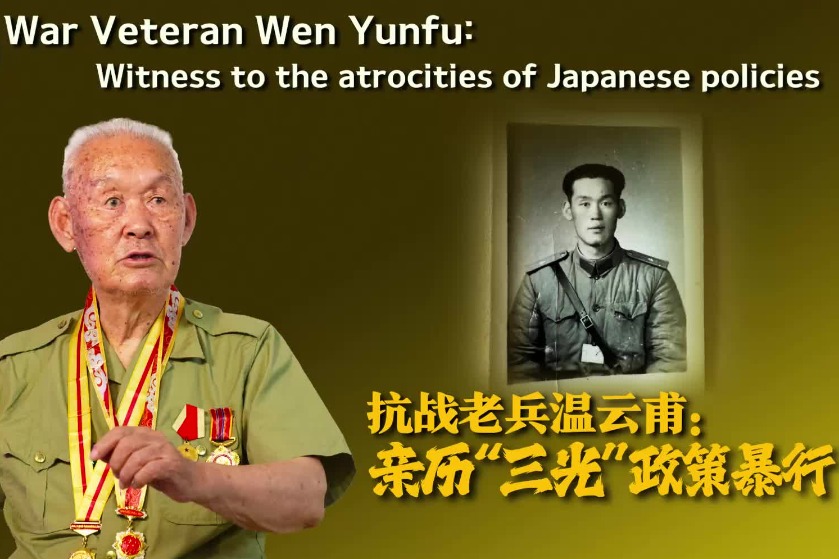

- China's top diplomat urges Japan to learn from its warring past

- China-built roads bring real benefits to Pacific region

- Japan must face up to its wartime past