Qualcomm Inc shares fell as much as 6.5 percent after the chipmaker said sales and profit in 2015 will be hurt by the fallout from a Chinese government probe and disclosed new regulatory investigations in the United States and Europe.

The company, the largest maker of smartphone chips, said the US Federal Trade Commission and European Commission are conducting inquiries related to its licensing and chip businesses. The probes, announced in a filing on Wednesday, follow a previously disclosed investigation by China's antitrust regulator into Qualcomm's business practices.

Chief Executive Officer Steve Mollenkopf is facing mounting challenges in China, the world's largest wireless market and a region that Qualcomm has been counting on to drive growth. As the Chinese government inquiry continues, some phone makers in the country are prolonging royalty negotiations and refusing to pay the company's required fees for using its technology standard, the part of its business that generates the bulk of its profit.

"It's not encouraging," said Stacy Rasgon, an analyst at Sanford C. Bernstein & Co in New York, who has the equivalent of a hold rating on the stock. "I would have thought the US government would have their back given what's going on in China, but apparently not."

The FTC is looking at Qualcomm's licensing division regarding fair and reasonable commitments, while the EU's probe concerns rebates or financial incentives related to its baseband chip business, Qualcomm said in the filing.

The investigations are in the preliminary stages, and it is not unusual for regulatory bodies to follow each others' leads in taking a look at a company, Qualcomm said.

Peter Kaplan, a spokesman for the FTC, declined to comment.

Qualcomm shares dropped as low as $72.20 in extended trading. They had gained less than 1 percent to $77.20 at Wednesday's close in New York, leaving them up 4 percent this year.

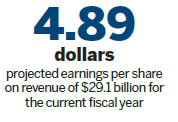

For the current fiscal year, which ends next September, Qualcomm predicted net income of $4.33 to $4.63 a share on sales of $26.8 billion to $28.8 billion. That compares with average projections of $4.89 a share in earnings on revenue of $29.1 billion.

Mollenkopf is trying to extend his company's dominance in high-speed Internet-capable phone chips to China as the world's most populous country upgrades its network to the standard known as long-term evolution.

Qualcomm is unique among large technology companies in the amount of profits it gets from licensing. Its ownership of a standard used in most modern phone systems has supplied it with the cash to build itself into one of the world's biggest chipmakers. It also puts the company in the position of seeking to collect fees from phone manufacturers based on the number of phones they sell that use its technology.

That has proved difficult in China, as Qualcomm waits for the results of an investigation announced in November 2013 by the National Development and Reform Commission. The agency, which helps enforce antitrust law, is looking at Qualcomm's licensing business and its interaction with the company's chip unit.

|

|

| Qualcomm's value takes $13b hit amid China probe | Qualcomm probed for price-fixing in China |