China's central bank is tightening rules on interbank bond market trading by ordering all transactions to be conducted through the National Interbank Funding Center as it seeks to boost transparency.

Transactions including forward deals and repurchases can't be reversed or changed once agreed between the two parties, the People's Bank of China said in a statement posted on its website on Tuesday. Clearing agencies should not engage in settling trades outside the interbank market, according to the statement. Alterations to bond ownership, such as inheritance that are not related to trading, must be supported by legal documents explaining the nature of the transaction, it added.

Chinese authorities are seeking to clean up the $3.8 trillion market and encourage companies to raise funds through bonds rather than relying on bank lending. The State Council, or China's cabinet, approved trading of government debt futures for the first time in 18 years to allow investors to hedge risk, the China Securities Regulatory Commission said this month.

"It's a continuation of the changes the government is making on an operational level to improve the bond-market system," said Becky Liu, a rates strategist at Standard Chartered Plc.

"We should expect more steps from the regulators to clamp down on illegal bond trading activities."

China opened its interbank bond market in December 2011 to more than 200 qualified foreign institutional investors, which were previously restricted to exchange-traded securities. The central bank allowed money-market rates to rise to records in June as it sought to discourage lenders from using short-term financing to cover longer-maturity loans.

The PBOC had ordered participants to submit self-examinations of their bond trading histories by May 10, two people with knowledge of the matter said. The checks focused on transactions between banks and associated investment companies, said the people, who asked not to be identified as they weren't authorized to speak publicly.

Some banks, seeking to move bonds off their balance sheets, paid other institutions to hold notes for a certain period, according to an April 22 China National Radio article. Interest payments and gains from price appreciation continued to belong to the original owner, according to the article. Such transactions are open to abuse including insider trading and the use of clients' funds for personal trades, it said.

All bond transactions need to be conducted with the National Interbank Funding Center and market participants will be banned from trading if they fail to connect their systems to the platform within a month, the PBOC statement said.

Chinese regulators also reined in money supply in June in a bid to force investors to shift money out of shadow banking into publicly traded securities.

The PBOC allowed the seven-day repurchase rate - a measure of interbank funding availability - to jump to a record of 12.45 percent in June as a reminder to lenders that they need to adjust their "asset businesses," Governor Zhou Xiaochuantold the Shanghai-based China Business News in a July 1 interview.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

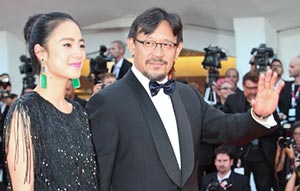

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant