Policy fine-tuning should be cautiously rolled out to prevent a rebound in prices, experts said, after inflation hit a 30-month low in July and stoked speculation of aggressive easing.

Meanwhile, the National Development and Reform Commission announced on Thursday that the retail price of gasoline would rise by 390 yuan ($62), and diesel by 370 yuan, a metric ton from Friday.

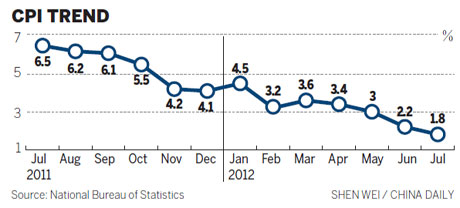

The consumer price index, a major gauge of inflation, rose 1.8 percent year-on-year last month, the slowest pace since February 2010, the National Bureau of Statistics said on Thursday.

The rate was 0.4 percentage points lower than in June and marked the fourth consecutive monthly fall.

"The falling CPI increases pressure on the government to further loosen monetary policy to restore growth," said Jin Linbo, vice-president of the National Academy of Economic Strategy at the Chinese Academy of Social Sciences.

"But this will not be an easy job, as further easing, if not appropriately applied, will lead to a bubble. Authorities have to be very cautious about each step they take," Jin said.

Chen Daofu, policy research chief at the Financial Research Institute at the State Council's Development Research Center, said the government should not rush into another interest rate cut when inflation concerns remain high among consumers.

"A better choice would be to lessen administrative controls, such as further widening the room for floating interest rates."

The People's Bank of China, the central bank, lowered interest rates twice in the past two months to bolster the world's second-largest economy, which reported the slowest expansion in three years in the second quarter at 7.6 percent.

However, a recent report by the central bank said the marginal effect of policy relaxation is declining and it could lead to a rebound in inflation.

"Bank reserve cuts and open market operations will be the main tools adopted in the near future," Chen said.

Liu Ligang, head of China economics studies at the Australia and New Zealand Banking Group, estimated that bank reserve requirements will be cut this month, and two more cuts are likely this year.

"Although there are still possibilities for further interest rate cuts, it might not be the best medicine for a cooling economy," Liu said, explaining that the economy will face even bigger challenges if interest cuts lead to a rebound in housing prices.

"Retreating CPI in the short term doesn't rule out long-term inflationary pressure," said Zhang Monan, an analyst with the State Information Center.

"Structural inflation, pushed up by the re-evaluation of assets and rising labor costs, continues to pressure companies and consumers," she said.

In a breakdown of July's index, food prices, which account for nearly one-third of the CPI, edged up 2.4 percent from a year ago, compared with 3.8 percent in June.

The increase was mainly driven by vegetable and fruit prices, as rain and flooding affected production in many areas in the traditional peak supply season. Pork prices saw a rise of 18.7 percent year-on-year.

Meanwhile, charges for domestic and maintenance services went up 10 percent year-on-year.

Transportation and communication are the only category in the basket to see their prices fall from a year ago. Fuel prices were down 4.4 percent year-on-year after three price cuts this year.

Shrinking demand

Cooling inflation was also a reflection of shrinking demand in the real economy, as companies struggling with overcapacity and falling profits, have to lower, or slow the growth of, product prices.

The producer price index, a main gauge of inflation at the wholesale level, fell 2.9 percent in July from a year earlier. This marked 12 months of consecutive declines.

But Zuo Xiaolei, an economist with Galaxy Securities said "retreating inflation isn't equal to deflation", allaying concerns over deflation.

"As long as the growth goal (7.5 percent) is achieved, there won't be deflation," she said.

Lian Ping, chief economist with the Bank of Communications, said the risk of inflation still outweighed that of deflation.

"The policy stimulus and change of local governments may lead to a new round of investment fever, which will boost prices."

Fixed-investment growth was 20.4 percent in the first seven months, according to the National Bureau of Statistics. And "investment will still be the key driver for a very long time", said a report by the Chinese Academy of Social Sciences.

A report by the China Merchant Securities estimates that inflation will stand at 1.9 percent in the third quarter and 2.5 in the fourth, with the yearly figure below 3 percent.

Contact the writers at weitian@chinadaily.com.cn and dingqingfen@chinadaily.com.cn