BOCHK hikes dividend 40% after H1 net improves

Updated: 2010-08-27 08:29

By Oswald Chen(HK Edition)

|

|||||||

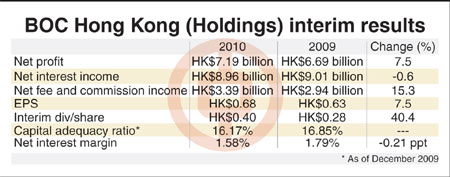

Propelled by an increase in net fees and commission income and a net reversal of impairment charges on securities investments, Bank of China Hong Kong (Holdings) Ltd's (BOCHK) first-half net profit improved 7.5 percent to HK$7.19 billion from a year ago.

The lender declared an interim dividend of HK$0.40 per share, representing a surge of 40.4 percent from a year earlier.

The lender's net interest income continued to be pressured by a narrower net interest margin (NIM), which fell 0.6 percent to HK$8.96 billion. The bank's NIM contracted by 0.21 percentage points to 1.58 percent.

Net fees and commission income rose 15.3 percent to HK$3.39 billion, helped by a 132 percent and 800 percent jump, respectively, in life insurance and IPO-related commission incomes.

The net reversal of the impairment charges of HK$161 million on securities investments also helped boost the net profit.

For the same period of 2009, BOCHK booked an impairment charge of HK$1.11 billion.

Vice-chairman and chief executive He Guangbei expects the NIM to remain at low levels until the first half of 2011.

"As the US maintains an ultra-loose monetary policy while fierce competition reigns the lending market, we anticipate that pressure on the NIM will last until the first half of 2011. However, we believe the traditional businesses will fare well in the future," He said.

He added that the lender will strive to maintain a stable dividend payout policy.

The bank will try to increase the dividend payout ratio from 59 percent in the first half of 2010 to around 60 to 70 percent, depending on the market situation.

Looking ahead, BOCHK said it will try to regain leadership in the city's mortgage business.

"There has been fierce competition in the traditional mortgage market that exerts negative impacts upon the bank. However, we will not sacrifice prudential risk management in the mortgage business for the sake of enlarging market share," He stressed.

BOCHK's total loan portfolio and deposits rose 11 percent and 5.7 percent from the end-2009, yielding a loan-to-deposit ratio of 64.02 percent. The bank's consolidated capital adequacy ratio stood at 16.17 percent at the end of June.

He said yuan-related businesses will be the growth engine for BOCHK in the future.

"We have achieved 38 percent market share of the local yuan deposit market. We will endeavor to support the Hong Kong stock exchange's plans to launch yuan-denominated interest rate futures in the city," He said.

China Daily

(HK Edition 08/27/2010 page3)