BOCHK posts H1 gains on strong loan growth

Updated: 2011-08-25 06:29

By Li Tao(HK Edition)

|

|||||||

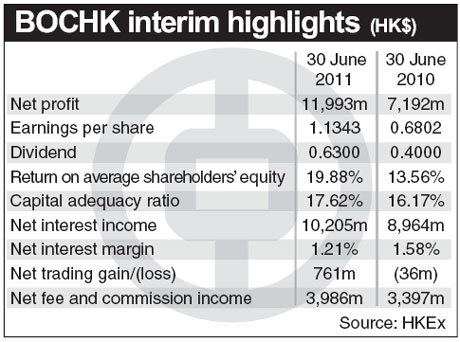

Core earnings climb 33.4% to HK$9.68 billion

Bank of China (Hong Kong Ltd), the city's second-largest lender by assets after HSBC Holdings Ltd, said its first-half core profit rose 33.4 percent from a year ago to HK$9.68 billion.

The interim profit, the most since its listing, was cited as due to strong growth in its core businesses.

Counting in the one-off HK$2.85 billion ($370 million) writeback on collateral recovery from its Lehman Brothers minibonds, BOCHK's net income for the six months ended June 30 reached HK$11.99 billion, up 66.8 percent from the HK$7.19 billion recorded a year ago, according to a statement to the Hong Kong Stock Exchange on Wednesday.

The lender, which is 66 percent-owned by Bank of China, said its first-half net interest income from core lending activities rose 13.8 percent to HK$10.21 billion from HK$8.96 billion last year, due to an increase of 48.7 percent in average interest-earning assets.

The net interest gain also offset the shrinking net interest margin (NIM), which narrowed by 37 basis points to 1.21 percent for the six months, compared with a NIM of 1.58 percent a year earlier.

He Guangbei, chief executive at the bank, attributed the drop in NIM to the intense competition for deposits among the lenders in the city, which has raised costs.

He added that the narrowing margin was also caused by the diluting effect of the lender's function as the yuan's clearing bank in Hong Kong. Otherwise the NIM should have narrowed by 16 basis points to 1.48 percent compared with 1.64 percent, He said, adding that this factor should be taken into account.

"The persistently low interest rates will continue to compress the interest spreads in the second half while BOC Hong Kong will seize the current strong demand for loans to raise the interest rate and better the NIM," He told reporters during a media briefing on Wednesday.

The lender registered a net trading gain of HK$761 million for the interim period of 2011 in comparison with a net loss of HK$36 million last year, led by the rise in net trading income from foreign exchange and related products as well as the drastic decrease in the loss arising from interest rate instruments.

Total loans and advances to customers increased by 9.7 percent to reach HK$672.9 billion, which was mainly contributed by an 8.5 percent growth in corporate loans and 14 percent growth in residential mortgage loans.

Chief Financial Officer Zhuo Chengwen told the press that more than half of the bank's debt and securities investment is within the Asia-Pacific region. Among the 20 percent debt and investment in Europe, about 90 percent are in major banks in the UK, the Netherlands, Germany and France, which are not likely to be affected by the ongoing European debt crisis.

The yuan business is now generating positive gains to BOCHK, which regards the yuan business as a "strategic focus", He said.

Adding that with the central government further loosening policies to encourage Hong Kong companies to invest directly on the mainland with the yuan, He said he believes that the yuan business will become a major income earner for the bank in the future.

China Daily

(HK Edition 08/25/2011 page2)