RMB deposit rates surge in price war

Updated: 2015-03-18 06:27

By Emma Dai in Hong Kong(HK Edition)

|

|||||||

|

Sentiment toward offshore renminbi bonds, or dim sum bonds, is "soft", due to higher volatility expected for renminbi, as investors are seeking more renminbi in hand for cross-border transactions and diversified usage of the currency. Daniel Acker / Bloomberg News |

Lenders in tussle for business amid tight liquidity

Hong Kong's renminbi (RMB) deposit rates have surged, triggered by a lackluster outlook for the mainland currency as well as multi channels for investment, and analysts expect the tight liquidity to continue for some time.

Local banks have been competing for RMB deposits, with at least eight lenders, ranging from banking giant HSBC to Wing Lung Bank, having launched promotion campaigns and boosted interest rates for RMB deposits to as high as 5 percent per annum.

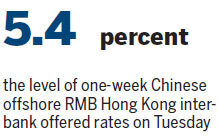

Interbank rates are also on the rise. One-week Chinese offshore RMB (CNH) Hong Kong interbank offered rates edged up by 138.5 basis points on Tuesday to 5.4 percent - the highest level since Feb 12. It's also 808.5 basis points above SHIBOR - the Shanghai Interbank Offered Rate - on the same day.

The price war is rooted in the leaking offshore RMB liquidity pool.

An increasing number of investment channels have been created to facilitate easier backflow of CNH, said DBC economist Nathan Chow Hung-lai. Overseas RMB holders now enjoy a variety of choices - the newly launched Shanghai-Hong Kong Stock Connect, a bigger aggregate quota of renminbi Qualified Foreign Institutional Investors Scheme and more demand for cross-border RMB pooling as well as RMB loans. "People have found more usage of the currency," Chow said.

On the other hand, a bleaker outlook for the currency has suppressed the accumulation of offshore RMB savings, he said, while a stronger US dollar has overshadowed local investors' appetite for offshore RMB.

Since October last year, the RMB has depreciated by 2.3 percent against the US dollar, hitting 6.25 yuan on Tuesday and having once retreated to 6.2751 yuan on March 3 - the lowest point in more than two years.

According to the Hong Kong Monetary Authority, the city's total RMB deposits currently stand at 981.4 billion yuan, compared with 1 trillion yuan in December last year.

While liquidity is tight for both the onshore and offshore markets, interest rates have risen even faster overseas, Raymond Yeung Yu-ting, senior economist at ANZ, pointed out.

"Some banks are willing to pay higher rates offshore to fill the onshore liquidity gap. There are also more cross-border transactions to facilitate onshore funding demands and arbitrage activities," he said.

Yeung said that, in the face of the US Federal Reserve's expected interest-rate hike, the offshore forward market has shown stronger prospects for the RMB to depreciate. "In order to maintain short-term liquidity of RMB, banks have to offer higher deposit rates now to offset currency risk concerns," he added.

Meanwhile, sentiment toward offshore RMB bonds - also known as dim sum bonds, is "soft", due to higher volatility expected for RMB, said an HSBC report published in March.

"Offshore yields of sovereigns and non-bank credits have outstripped their onshore peers for the first time. CNH yields are attractive in RMB terms, but the market is still looking for a further currency correction, keeping dim sum bond investors on the sidelines," the report noted.

A meaningful recovery depends on a near-term trough in the foreign exchange rate - a spot at 6.3 yuan per dollar can "lure dim sum investors back" - the bank estimated.

"As more channels were established for cross-border capital flows, dim sum yields have risen to onshore levels now. We think the dim sum market is likely to remain subdued for some time until the currency sentiment improves," said Crystal Zhao, an HSBC analyst specialized in the sector.

However, what's on the way may be further depreciation, given that further easing is likely.

The two sessions that ended last week have sent a clear message that the central bank will launch more monetary easing measures this year to feed the cash-thirsty market, Yeung said.

The bank forecasts two more rounds of cuts in the reserve requirement ratio, 50 basis points each, in the second and third quarter of the year, to be followed by a 25-basis point cut in benchmark interest rates in the second half.

However, such easing measures are not likely to solve the problem for banks offshore. Instead, tight liquidity is to continue at least into the near term, said Chow.

"As the time of one-way bet on the appreciation of yuan is behind us, CNH liquidity now depends on mainland companies' overseas direct investments. Mainland authorities need to open up more channels for the outflow of yuan, encourage enterprises to go abroad and allow Hong Kong banks to borrow from the onshore inter-bank market," he said.

"Such policies will help to boost liquidity in the offshore yuan market and keep funding costs reasonable, thus promoting cross-border fund raising activities and supporting the internationalization of yuan," Chow said. "But such policies - involving opening up the mainland's capital account - could only be implemented gradually."

Separately, as more stock market link programs are pending, Chow said pressure on offshore RMB liquidity could rise.

"The stock connect between Shenzhen and Hong Kong will probably kick off sometime this year. It could siphon liquidity and stretch the offshore market further," he said. "But we expect the impact from the Shanghai-Hong Kong cross-trading link to grow only moderately as overseas investors need time to adapt."

emmadai@chinadailyhk.com

(HK Edition 03/18/2015 page1)