US OKs Alibaba structure

Deal could be biggest tech firm debut since Facebook's IPO

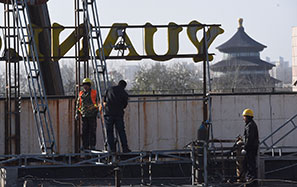

Alibaba Group Holding Ltd has paved its way for a listing in the United States after both of the country's bourses are said to have given the green light to the e-commerce giant's special corporate governance structure, which derailed the company's initial public offering plan in Hong Kong.

A representative for Alibaba said on Monday that both the New York Stock Exchange and the Nasdaq had accepted the e-commerce company's special partnership structure, which would let its top executives nominate the majority of board members.

"Apart from saying the two bourses have confirmed to accept Alibaba's partnership structure, we have nothing more to comment," said the representative.

Despite the progress, the company has not made a timetable for the IPO and has neither chosen its listing venue nor the underwriter, the representative added.

Founded by former English teacher Jack Ma, the Hangzhou-based Alibaba has become king of China's e-commerce sector. Not only is the company's upcoming IPO expected to be the biggest debut by a technology company globally since Facebook Inc's $16 billion listing last year, but many analysts and bankers also estimated that Alibaba's value would exceed $100 billion after the IPO.

Despite a seemingly promising future, Alibaba's road toward a listing has been a bumpy one. Earlier this month, Jonathan Lu, Alibaba's chief executive officer, said the company has dropped its plan to launch the IPO in Hong Kong, Alibaba's top choice for listing.

Alibaba's partnership structure - a group of 28 partners, who are mainly founders and senior executives make all the key operating decisions despite only owning about 13 percent of the company - was the deal breaker that cost the company's plan to list on the Hong Kong stock exchange, which insisted that all shareholders should be treated equally.

The Hong Kong bourse has made it clear that it doesn't allow a dual-class share structure, while Alibaba has repeatedly stated that what it wants is not a dual-class share structure but merely a company management style.

The heated debate between the two sides has resulted in a blog entry written by Alibaba Vice-Chairman Joe Tsai, who said last month in his blog that "Hong Kong had to consider what was needed in order to adapt to future trends or risk becoming content to look on as the rest of the world passed it by".

Despite the war of words and the fact that Alibaba got the go-ahead from the US bourses to keep its partnership structure, Lu Zhenwang, a Hangzhou-based independent e-commerce analyst, doesn't think Alibaba has completely given up the idea of listing in Hong Kong.

"The only challenge for Alibaba to list in Hong Kong is its partnership structure. But to list in the US, there are more hurdles for Alibaba to jump," Lu said.

"Not only would Alibaba's variable interest entity structure make it very complicated to list in the US, the company's reputation is also tainted for some US investors because of the fact that counterfeit and smuggled goods are sold in Alibaba's online marketplaces," he said.

Since Alibaba hasn't made an official announcement about listing in the US, Lu said he thinks the company may still want to fight its way back to Hong Kong.

However, Ricky Zhong, founder of imeigu, a leading online platform offering stock information about US-listed Chinese companies, said that it seems the deal is sealed for Alibaba to launch its IPO in the US.

He refused to comment, citing Alibaba's IPO as a "sensitive issue". But a post he published on imeigu's website said "it is a good thing for Alibaba to list in the US".

"From the perspective of investors, the valuation of the company would be more reasonable and the information disclosure mechanism in the US is better," he said.

mengjing@chinadaily.com.cn

|

An Alibaba employee walks through a communal space at company headquarters in Hangzhou, Zhejiang province. Peter Parks / AFP |