Putin looks to RMB to replace greenback

Russia has developed a strong appetite for the Chinese currency, reports Bloomberg in Moscow.

Vladimir Putin has a secret agent in his campaign to curb the impact of sanctions on Russia's economy: Mr Yuan.

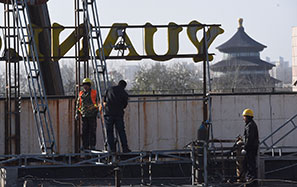

That is what skeptical bankers started calling Igor Marich after he introduced yuan trading in Moscow in 2010, when Russia became the first country outside China to offer regulated renminbi purchases. Now, as sanctions from the West over the conflict in Ukraine are prompting more Russian companies to look east for growth, Mr Yuan has become something of an honorific.

The yuan-ruble trade on the Moscow Exchange, where Marich runs money markets, has jumped tenfold this year to $749 million in August, though still a sliver of the $367 billion in dollar-for-ruble sales. Yuan buying hit a then-peak of 666 million yuan ($109 million) on July 31, when the European Union penalized Russia's largest banks, OAO Sberbank, VTB Group and OAO Gazprombank, over Putin's support for Ukraine's insurgency. With European Union and United States sanctions in place, and ties with China deepening, daily trading will soon reach 1 billion yuan, Marich said.

"I believe we can see this result within a year," the 40-year-old sports enthusiast said in an interview at the exchange in central Moscow, where he started working in 2000, the same year Putin became president.

Marich's goal may come sooner than he thinks. Russia is considering accepting yuan for gas under the $400 billion, 30-year supply deal that China signed during Putin's visit to Beijing in May, according to four senior Russian officials and executives who asked not to be identified because a final decision has not been made.

China agreed to prepay for supplies, which are scheduled to start in 2018, to help state-run OAO Gazprom finance the construction of the pipeline that will carry the fuel to the border. Introducing yuan payments into the gas business would lead to an exponential rise in trading in the Chinese currency in Moscow, the people said. China is already Russia's largest trading partner, with turnover of $89 billion last year, according to Russian customs data, and Putin has set a goal of reaching $100 billion next year.

Gazprom and its Chinese partner, China National Petroleum Corp, the country's biggest oil and gas producer, have so far declined to comment on the financial details of the accord.

Under Putin, Russia has moved to end what he's called the "dollar monopoly" that allows the US to act like a global economic "parasite". The US debt binge that triggered the worst financial crisis since the Great Depression six years ago exposed the need, according to Putin, for a counterweight to the US-led International Monetary Fund and World Bank. The issue became more acute after Crimea joined Russia in March, which sparked the first round of sanctions.

In July, 70 years after the Bretton Woods agreement formed the Washington-based IMF and World Bank, Putin and his BRICS counterparts from China, India, Brazil and South Africa created their own development lender and reserve fund with the equivalent of $200 billion of combined capital.

That agreement was signed amid a months-long decline in the ruble, which has weakened 15 percent versus the dollar this year, the worst performance among emerging markets after Argentina's peso, according to data compiled by Bloomberg. It's fared little better against the yuan, falling 14 percent.

History shows that fighting the greenback is an uphill battle: The US currency's preeminence in global finance has not budged in three decades. Almost 90 percent of the $5.3 trillion a day in foreign-exchange transactions last year involved the dollar, the same share as in 1989, data from the Bank for International Settlements show.

Russian companies have a total of $90.5 billion of dollar bonds due before 2020, almost all of it borrowed before the first sanctions over Ukraine were imposed. That compares with the equivalent of $19 billion worth of bonds denominated in euros and $864 million of yuan notes, data compiled by Bloomberg show.

Still, yuan-ruble trading is growing faster than any other pair of currencies on the Moscow Exchange. And unlike the dollar and euro, which attract a lot of speculative trading, almost all yuan buying is for settling commercial contracts, said Andrei Dorfman, a senior currency trader at Bank Moskvy.

Russia's central bank said in response to e-mailed questions that it considers increasing the yuan's role in the money market "one of its main priorities." One way it plans to do that is through a currency swap with China to boost bilateral trade and investment, Russian central bank Chairman Elvira Nabiullina said in July. The Moscow Exchange said on Tuesday it will begin ruble trading for Hong Kong dollars to deepen ties with China, though it has not set a start date yet.

"Currency swaps are like doping in sports for expanding foreign trade ties," Moscow Exchange Executive Director Alexander Potemkin, a former deputy central bank chairman, said in an interview. "Swaps will increase liquidity in Russia, which is currently limited due to Western sanctions."

None of this would have been possible before Putin arrived in the Kremlin because before then, the central banks in Moscow and Beijing had little to do with each other, according to Viktor Melnikov, who oversaw the start of yuan trading on the Moscow Exchange when he was deputy chairman of the central bank.

Back in 2000, Russia was "flooded with Chinese goods", yet only 14 correspondent accounts existed between Russian and Chinese banks, all created during the Soviet era and all with "zero balances", Melnikov said in an interview. "I thought that was odd, so I moved to change the situation."

After flying to the Chinese capital for talks with his counterpart, Melnikov, who now heads the Russian-Iranian Council at the Russian Chamber of Commerce, said he traveled to the northern city of Heihe in Heilongjiang province and was "astonished" by the amount of cross-border trade??20 Ilyushin Il-76 cargo planes filled with Chinese goods flying into Russia from Beijing every day.