Belt and Road indexes to aid investors

|

ICBC Standard Bank launches indexes to track Belt and Road opportunities. Cecily Liu / China Daily |

ICBC Standard Bank's tools will provide transparent, quantifiable information on countries involved

ICBC Standard Bank has taken steps to make opportunities connected with the China-led Belt and Road Initiative transparent and quantifiable through two groundbreaking indexes it launched last week.

The two indexes pull data from 65 countries involved in the Belt and Road in Asia, Africa and Europe and standardize the data sets to help investors spot opportunities by making easier comparisons between the countries. Wang Wenbin, ICBC Standard Bank chairman, says the Belt and Road is attracting investors from around the world. The initiative "is not just hot on the Eastern part of the world but here today at the Western end of the B&R. Lots of decision makers, investors and analysts are focusing on it."

Wang says the lack of standardized analytical tools to understand Belt and Road opportunities motivated his team to create the indexes. "People are worried that across the 65 countries, what are the real opportunities and risks, and how do you balance them? That is why we launched these indexes," he says.

ICBC Standard Bank was created in 2015 when Industrial and Commercial Bank of China acquired a 60 percent stake in the Johannesburg-based Standard Bank's London-based global markets business. The resulting London-based entity was renamed ICBC Standard Bank.

The banks wanted to build a global commodities leader by combining Standard Bank's commodities trading and hedging expertise, especially involving African economies, with the vast market network ICBC offers in China and other emerging economies.

"We are especially positioned in commodities, fixed income, forex, derivatives and risk solutions. We also have a unique position in emerging market finance," Wang says.

Despite the bank's optimistic ambitions, the joint venture still has some way to go before it can call itself a success. In 2016, the bank recorded a loss attributable to shareholders of $98.8 million (86 million euros; £76 million), despite operating income of $286 million. But this was an improvement on the loss of $267.7 million in 2015.

The global commodities downturn, which began after the 2008 financial crisis and has still not fully recovered, has affected the bank's business, although in recent years it has been adjusting and finding new areas for growth.

The bank said in its 2016 annual report that improved revenue performance is partly due to improving market conditions toward the later part of 2016 and further supported by additional collaboration with ICBC and its clients. The bank's ability to find cheaper funding sources and more efficient management of surplus liquidity also contributed to improved revenue performance, it said.

Meanwhile, the creation of the two Belt and Road indexes reflects strong efforts by the bank to unlock new opportunities. The indexes' creation also is a use of the bank's existing strength in countries on the Belt and Road map.

The two indexes are the ICBC Belt and Road Economic Health Index and the ICBC Belt and Road China Connectivity Index, to be updated monthly and semi-annually. Countries' rankings in the index and how their rankings change in updated indexes can flag investment opportunities.

The inaugural economic health index found that, despite sovereign and external risk being at multiyear highs, economic health is at a 10-year high, driven by an improvement in market fundamentals.

The top macro-performers are grouped in two categories: the "big three" of China, India, and Vietnam - large emerging markets with strong growth prospects; and the "nimble four" of Qatar, Singapore, Estonia and the United Arab Emirates - smaller markets with quality investment climates.

Meanwhile, the China Connectivity Index has tracked economic connectivity between China and Belt and Road economies by monitoring activity of trade and capital and the movement and employment of people.

The Belt and Road indexes are closely linked to the bank's services and expertise in the Belt and Road countries. Its main activities in these countries include the provision of risk management services and commodity hedging for producers and consumers, and providing them with structured financing. ICBC, with its strong financing capability, is well positioned to provide much of the financing needed in these countries through its local entities.

The Belt and Road Initiative has already received support from more than 100 countries and international organizations, more than 40 of which have signed cooperation agreements with China.

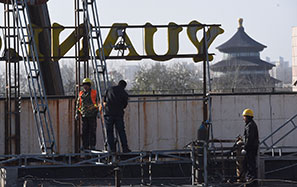

At the Belt and Road Forum for International Cooperation in Beijing in May, China committed an additional $14.6 billion to the Silk Road Fund, which invests in infrastructure along the routes, adding to its initial commitment of $40 billion in 2014.

Participants like the State-owned ICBC, which has 127 subsidiaries and branches established in the Belt and Road countries, already play a significant role. By the end of 2016, ICBC has financed a total of $80 billion across 300 projects in the Belt and Road countries.

Since the joint venture's establishment, ICBC Standard Bank is now involved in many new markets, becoming more involved with China. It is also developing more products so its customers can invest and manage risk across markets.

Meanwhile, ICBC Standard Bank has also maintained its strength in commodities markets. It is a member of 11 commodity trading exchanges worldwide, which gives it the strength and capability to offer clients suitable solutions and favorable prices.

Its commodities strength focuses on precious metals, base metals, bulk and energy. In a move to strengthen the bank's clearing and storage services for precious metals, ICBC Standard Bank bought Barclays London's precious metals vaulting business in 2014. Barclays opened its state-of-the-art vault, at a secret location in London, in 2012, after a 12-year bull run in gold prices pushed the metal to record highs the previous year.

Guido Haller, head of global markets at ICBC Standard Bank, says the bank's purchase of the gold vault highlights its focus on precious metals, and fits in with the bank's continued strategy to become a dominant player in gold and precious metals in general. "It is important to understand that, without ICBC, these aspirations would be more difficult to achieve. Through ICBC, we have a profile and natural access to the Chinese markets that gives us the scale and opportunity we wouldn't normally have," Haller says.

The bank's base metal business has its roots in Africa, the center of base metals mining, where Standard Bank has been involved in the supply chain. Despite the collapse of base metal prices over the past few years, Haller says his team is adapting to the changes. "We continue to see base metal as core to us, especially because our shareholders are the largest banks in China and Africa," he says.

In energy, ICBC Standard Bank sees many opportunities, although it now has a small role. "There are currently no Chinese financial institutions involved on the physical energy trading side. We see many inquiries from Chinese companies, so we are building a focus on Chinese companies and other multinationals," says Haller.

Haller, who previously worked for Standard Bank, running its global markets business in Africa, decided to join the ICBC Standard Bank joint venture in London when it was established in 2015.

He acknowledges that the marriage of the two banks still encounters cultural differences, but stresses that communication is key for integration. "Our cultures are quite different. I don't think culture is an impediment. The key thing for us is communication. So building communication networks is what we spend much time doing," he says.

cecily.liu@mail.chinadailyuk.com