Guarding against risks for a sound financial sector

|

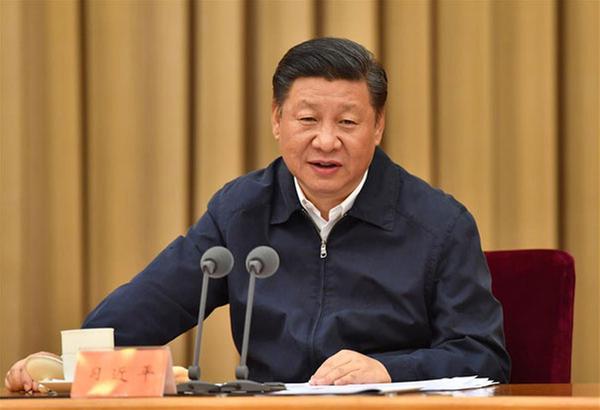

| President Xi Jinping speaks at the National Financial Work Conference in Beijing July 15, 2017. [Photo/Xinhua] |

The two-day National Financial Work Conference, which ended in Beijing on Saturday, made containing financial risks one of the country's top priorities.

The meeting, presided over by President Xi Jinping, was held against the backdrop of growing enterprise debt, an overheating real estate market, and overcapacity in such sectors as low-end manufacturing.

The debt of non-financial enterprises in China reached 170 percent of its GDP in 2016, according to the Organization for Economic Cooperation and Development.

And in its 2017 China Financial Stability Report released early this month, China's central bank, People's Bank of China, pointed to "the risk of bubbles" emerging in some parts of the country. The report notes that housing loans comprised a quarter of all loans, and accounted for 44.8 percent of all new lending since the start of this year.

All this, as well as the risks in interbank and off-balance sheet business, prompted the central bank to emphasize the need for strengthened financial regulatory capability and better regulatory coordination in its report. Only through guarding against financial risks can a sound and stable financial sector better fulfill its duty and purpose of serving the real economy.

The lack of cooperation among the China Securities Regulatory Commission, the China Banking Regulatory Commission and the China Insurance Regulatory Commission was to blame for some of the problems and potential risks in the financial sector and many believe it has also encouraged regulatory arbitrage and fueled the growth of risky financial products.

Thus a committee is to be set up under the State Council aimed at markedly improving coordination among the three agencies and promoting greater sharing of information and plugging gaps in their oversight.

Despite some ringing the alarm bells, the risks in China's financial sector are controllable. Bad bank loans remain at a low level, liquidity in the market is stable, and sound economic growth in the first half of the year means the central bank does not need to continue to expand credit to spur growth, thus providing more leeway for financial reform measures.

And the government will continue to deleverage the economy by implementing a firm and prudent monetary policy, reduce the leverage of State-owned enterprises and local government debt, and crack down on financial irregularities.

As Xi said at the meeting, the government must take the initiative to monitor, warn against and deal with risks in a timely manner. The new committee will help do these.