Tianjin Updates

2026-01-07

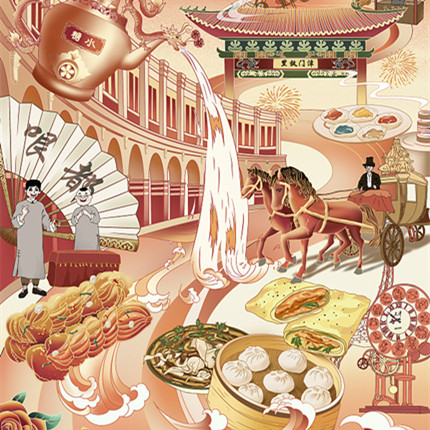

Tianjin bookstore binds readers' interests together

A flagship bookstore in Tianjin is fast becoming a must-visit in the port city, as crowds flock there not just for the books, but for the stylish atmosphere, stunning architecture, and for a place to socialize and attend events.

read more- Tianjin Medical University establishes ophthalmology alliance, supporting SCO countries

- Tianjin's hospital advances integrated Chinese and Western orthopedic treatments

- Tianjin University unveils initiative aimed at developing innovative leaders

Copyright ©? Tianjin Municipal Government.

All rights reserved. Presented by China Daily.

京ICP備13028878號-35

Why Tianjin

Why Tianjin Investment Guide

Investment Guide Industry

Industry Industrial Parks

Industrial Parks

Health

Health Visas

Visas Education

Education Sports and recreation

Sports and recreation Adoption

Adoption Marriage

Marriage